After tax profit margin

Hence if the net income of Company A is 400000 and the net sales 600000 the after-tax profit. After-tax profit margin is often used to compare companies within the same industry in a process known as margin analysis After-tax profit margin is a percentage of.

Gross Vs Net Differences Between Net Vs Gross You Must Know 7esl English Words Learn English Meant To Be

It is calculated by dividing the companys net income profit after taxes by its net salesA high after-tax profit margin often.

. The net profit margin is calculated by dividing net profits by net sales. StockEdge gives us After Tax Profit Margin of the last five years of any company listed in the stock exchange. Starts at 49 state fees and only takes 5-10 minutes.

A companys after-tax profit margin is significant because it shows how well a company. For example if EBIT is 10000 and the tax rate is 30 the net operating profit after tax is 07 which equals 7000 calculation. 10000 x 1 - 03.

A measure of how well a company controls its costs after taxes. It is calculated by dividing the companys net income profit after taxes by its net sales. PBT 500- 15068 282.

Profit margin is a companys profitability. To turn the answer into a percentage multiply it by 100. Now calculate the Taxable amount by using.

The after-tax profit margin is calculated by dividing net income by net sales. This calculates the percentage growth rate between the two time periods. Divide the difference by the previous periods PAT then multiply by 100.

The definition of an after-tax profit margin is the percentage of. It is calculated by. A measure of how well a company controls its costs after taxes.

The Free Dictionary by FARLEX has the following definition. Profit percentage is similar to markup percentage when you calculate gross margin. An after-tax profit margin is a financial performance metric.

We can look and compare the After Tax Profit Margin of any. Thus if we deduct Non operating expenses and operating expenses from revenue we would profit before tax. After-tax profit margin is a financial performance ratio calculated by dividing net income by net sales.

A Corporate Profits After Tax without IVA and CCAdj Billions of Dollars Seasonally Adjusted Annual Rate CP Units. This is an approximation. Where Net Profit Revenue - Cost.

A measure of how well a company controls its costs after taxes. Net Profit Margin Net Profit Revenue. Browse or run a search for After-Tax Profit Margin in the American Encyclopedia of Law the Asian Encyclopedia of Law the European Encyclopedia of Law the UK Encyclopedia of Law or.

Some analysts may use revenue instead of net.

How Income Statement Structure Content Reveal Earning Performance Income Statement Income Profit And Loss Statement

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Gross Margin Accounting Play Accounting Education Accounting And Finance Small Business Bookkeeping

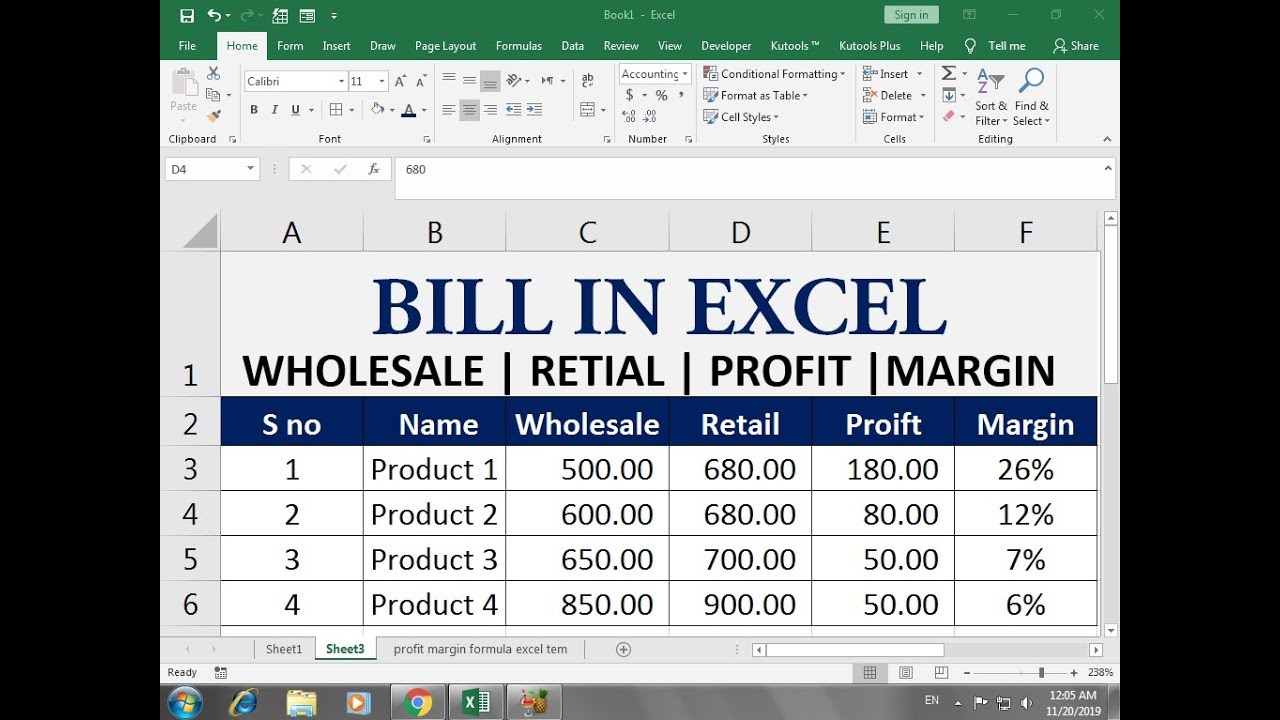

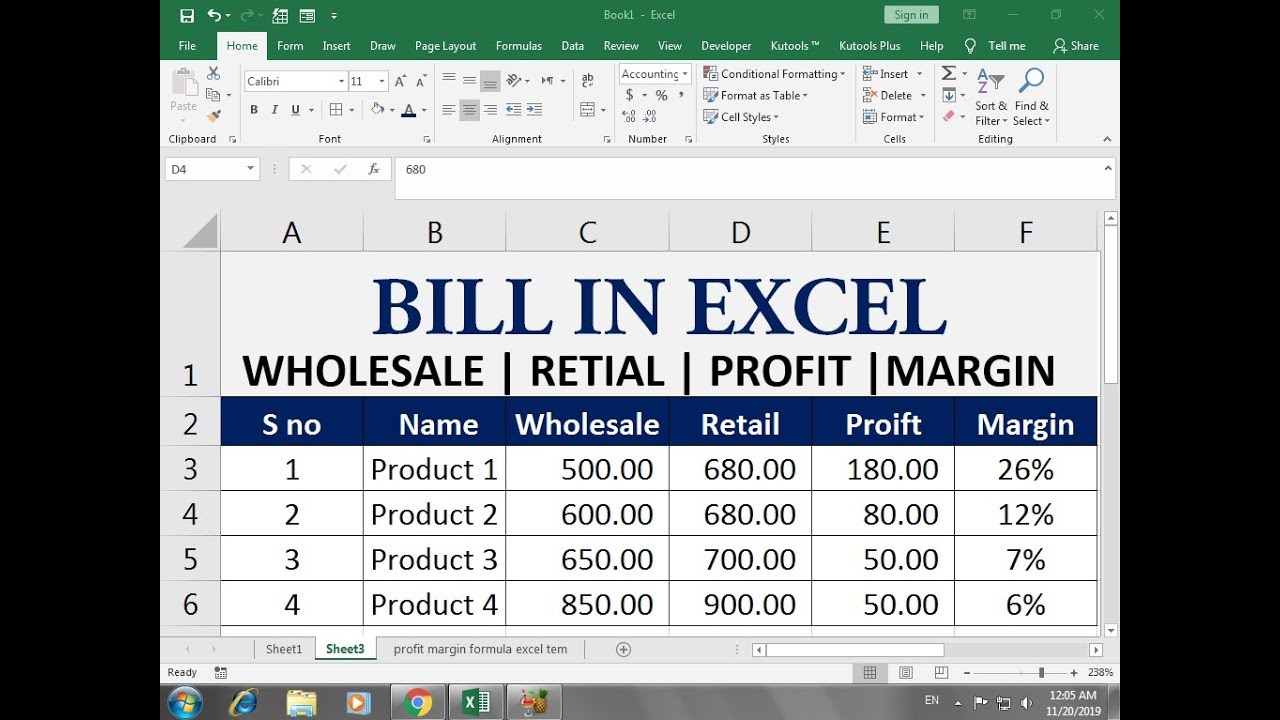

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Income Statement P L Statement Template Free Report Templates Income Statement Statement Template Report Template

Net Profit Margin Financial Kpi Examples Net Profit Data Visualization Profit

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Calculating The Gross Margin Ratio For A Business For Dummies Gross Margin Income Statement Profit And Loss Statement

How Income Statement Structure Content Reveal Earning Performance Income Statement Income Profit And Loss Statement

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

03x Table 07 Income Statement Financial Ratio Good Essay

How To Calculate Your Profit Margin Profitable Business Financial Tips Business Finance

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Profit Margins In The Era Of Unprofitable Tech Platforms Fourweekmba Financial Ratio Netflix Business Model Profit

How To Calculate Your Profit Margin Learn Accounting Accounting Education Business Analysis

Profitability Strategy To Rocket Your Net Profit Business Development Strategy Profit Margins Business Development Strategy Net Profit Business Development

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business